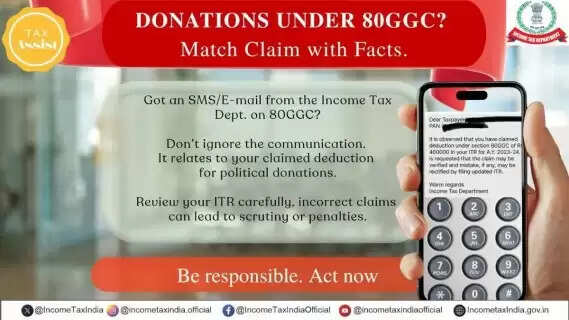

The launch of TAXASSIST helps in easing the burden for the taxpayers of our country. With this system, those who need to file returns can retrieve answers to their queries and file returns seamlessly. While explaining the latest initiative, the Income Tax Department underscored its goal to simplify every aspect of concern regarding taxes. Furthermore, the Income Tax Department brought to notice the possible challenges taxpayers availing exemption under section 80GGC would run into during the claiming process.This section provides tax exemption to persons who make donations to a political party or electoral trust. To ensure understanding, the Department shared different scenarios explaining how TAXASSIST assists claim documenting, clarifying and responding to notices. This initiative was created in a bid to streamline and increase efficiency for taxpayers.Case 1: Exemption claimed by mistake If a taxpayer wrongly claims exemption under 80GGC, TAXASSIST suggests revising their return by filing ITR-U and paying the tax with interest, along with returning the excess refund. Not doing so may lead to a penalty or scrutiny.Case 2: Claim of fake donationIf an exemption has been claimed using fraudulent or illicit political donations, this will be regarded as tax evasion. In such situations, TAXASSIST will guide the taxpayer to opt for ITR-U filing and pay the due tax along with interest, in order to avoid any legal complications. Case 3: Donation claim In case the donation is made to recognized political parties, TAXASSIST recommends retaining the donation receipts and bank transaction proof as they may be useful if an inquiry arises. This is part of the proactive steps taken by the Income Tax Department to streamline the tax filing process. <blockquote class="twitter-tweet"><p lang="en" dir="ltr">Introducing "TAXASSIST" <br>your go-to support for all tax concerns!<br><br>From helping you navigate departmental communications and keeping your finances in check, to reminding you of key tax deadlines<br>This campaign is designed to guide, support, and simplify.<br><br>Stay informed. Stay… <a href="https://t.co/Kg3flUM80f">pic.twitter.com/Kg3flUM80f</a></p>— Income Tax India (@IncomeTaxIndia) <a href="https://twitter.com/IncomeTaxIndia/status/1939634595450015903?ref_src=twsrc%5Etfw">June 30, 2025</a></blockquote> <script async src="https://platform.twitter.com/widgets.js" charset="utf-8"></script>Deadline for filing returns is 15 September This year, the Income Tax Department has shifted the deadline for filing returns from July 31 to September 15. This change is intended to ease the burden on taxpayers. The new deadline for filing Income Tax Return (ITR) for the financial year 2024-25 remains September 15, 2025.

Around the web