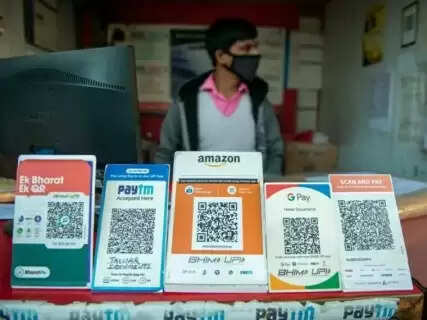

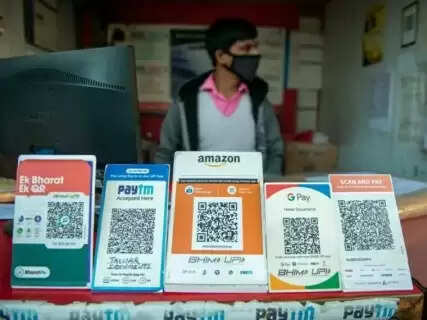

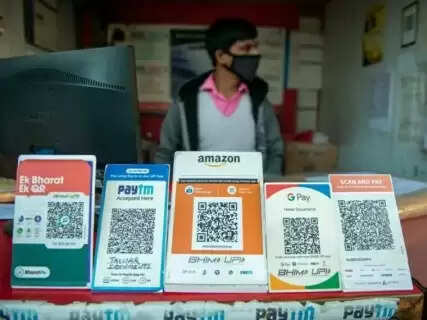

Beginning August 1, 2025, a significant modification will affect users of UPI applications—such as PhonePe, Google Pay, and Paytm—who execute daily transactions. The National Payments Corporation of India (NPCI) will introduce revised operational guidelines aimed at enhancing the speed, security, and reliability of the UPI ecosystem. While the specifications may initially appear technical, their influence will be felt during routine digital payment activities.India’s UPI network currently handles more than 16 billion transactions each month. Nevertheless, consumers occasionally report server slowdowns and transaction delays. In response, the NPCI has delineated seven substantive reforms.Daily balance inquiry capThe first reform concerns the daily limit on balance inquiries. Users will be permitted to perform such queries a maximum of 50 times each day through their UPI applications. Excessive balance checks impose cumulative strain on the servers and can consequently disrupt transaction throughput. By capping the daily inquiries, the NPCI anticipates a more stable operational environment. Daily inquiry cap on linked accountsAdditionally, users will be restricted to a maximum of 25 daily checks on the bank accounts linked to their mobile numbers. This restriction is intended to alleviate unnecessary strain on the underlying infrastructure and to diminish the risk of account-related fraud.Change Regarding Autopay TransactionsAutopay transactions, such as those for streaming subscriptions or mutual fund contributions, will henceforth be processed during three designated time windows: before 10:00 a.m., between 1:00 and 5:00 p.m., and after 9:30 p.m. This scheduling is designed to mitigate server load during peak operational periods.Limit on Status Inquiry for Failed TransactionsThe next adjustment establishes a restriction on inquiries regarding failed transactions. Users may now check a failed transaction’s status no more than three times within a twenty-four-hour period, with an enforced minimum delay of ninety seconds between successive attempts. This measure aims to preserve system performance by reducing strain on the inquiry infrastructure.Visibility of Recipient Bank NameEffective from June 30, and prior to the final deadline of August 1, the registered bank name of the transaction’s recipient has been made visible to the sender prior to payment confirmation. This transparency is expected to lower the incidence of funds being misdirected and to deter fraudulent activity.Chargeback LimitationFinally, the policy on payment reversals—commonly referred to as chargebacks—has been codified. A user may initiate a chargeback request up to ten times within a rolling thirty-day window, and no more than five times with respect to a single individual or institution during the same period.In addition, NPCI has mandated that banks and third-party applications implement continuous monitoring of API traffic to preclude system-level anomalies. These measures constitute a further bolstering of the UPI infrastructure. Users are advised to discontinue the practice of frequent balance inquiries or status refreshes. Recurrent autofacilitation transactions should be scheduled during identified off-peak intervals, and the beneficiary name should be independently verified prior to final confirmation. Adherence to these directives will enhance transaction velocity and security, thereby ensuring a seamless digital payment experience.UPI rules August 1, UPI payment changes, PhonePe new charges, Google Pay fees August, Paytm UPI update, prepaid payment instruments UPI, UPI MDR, 1.1% UPI fee, NPCI UPI regulations, UPI transaction charges, wallet to bank UPI charge, new UPI payment rules, August 1 payment changes, digital payment India, UPI charges explanation, RBI UPI guidelines, UPI PPI transactions, interchange fee UPI, financial regulations India, payment app charges,UPI MDR charges explained,what are prepaid payment instruments in UPI,PhonePe Google Pay Paytm UPI fees August 1,impact of UPI PPI charges on users,NPCI circular on UPI PPI charges,UPI payment rules August 1 prepaid instrument charge 1.1%