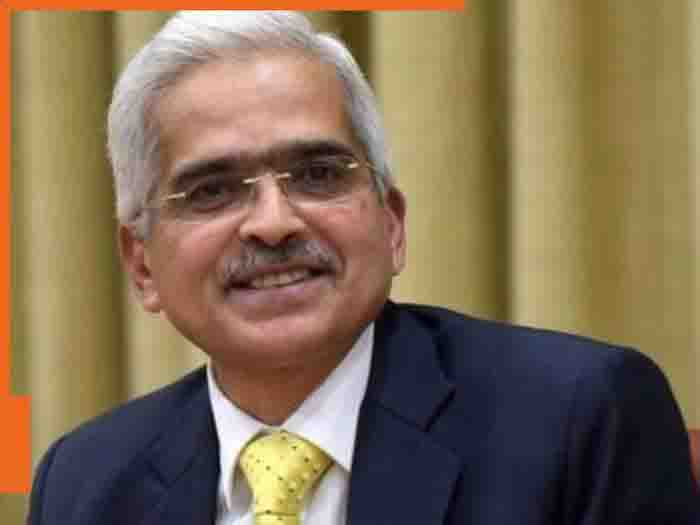

The Reserve Bank of India (RBI) today announced the decision of its monetary policy meeting. RBI Governor Shaktikanta Das said that for the 11th consecutive time, no change has been made in the repo rate. This means that borrowers will not get any relief in their EMI. The Monetary Policy Committee (MPC) has decided to keep the interest rate unchanged at 6.5%.

Cut in CRR

However, RBI has reduced the Cash Reserve Ratio (CRR) by 0.5%. Now it has come down to 4%. This will facilitate banks to give more loans and they will get more liquidity. This step reflects the neutral policy of RBI, which will maintain more liquidity in the market.

Concern over food inflation

The RBI governor said that food inflation may persist in the third quarter of FY25, but it may decline in the last quarter of the year. He said that food inflation reduces the disposable income of consumers, which affects spending and economic activity. Apart from this, weather-related events, financial instability, and geo-political risks can affect inflation.

Optimism on GDP growth

GDP growth in the second quarter was lower than expected, which worried many experts. But Shaktikanta Das expressed hope that high-frequency indicators show that domestic activity is now coming out of its low state. This indicates that the economic situation may stabilize.

It is worth noting that RBI's policies will have a significant impact on the Indian economy in the coming times. No change in the repo rate may be disappointing for borrowers, but a cut in CRR will strengthen the banking system. RBI is keeping an eye on food inflation and GDP growth, which can affect the economy in the coming months.

--Advertisement--

Share

Share