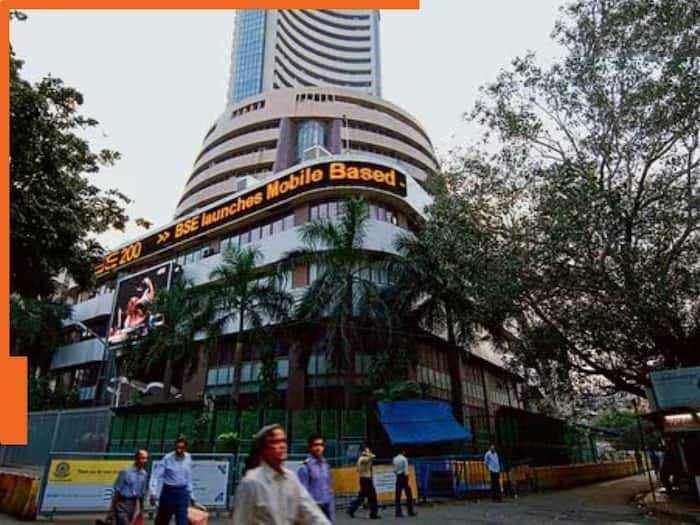

The Indian stock market has started in the green today on Tuesday. At around 10:36 am, the Sensex was trading at 78,262.63 with a gain of 921.62 points (1.19%), while the Nifty was also up 271.90 points (1.18%) at 23,725.90. The market trend was looking positive today.

Media and realty stocks rise.

In today's early trade, there was a tremendous rise in the shares of the media and realty sector. Nifty media and realty index gained more than 2%, due to which investors in these sectors got good benefits.

Performance of other sectors

In the Sensex pack, major stocks like NTPC, Tata Motors, M&M, Adani Ports, Infosys and Power Grid gained. The stocks of these companies contributed to the market's growth. At the same time, some stocks like Kotak Mahindra Bank, Sun Pharma, and Bajaj Finserv declined and were the top losers.

Market Trends for Investors

However, market experts say that there is no hope of a sharp recovery right now. The market has slowed down since it touched record highs in September. FIIs' selling and weak expectations of earnings growth in FY25 can also affect the market recovery. However, this can be a positive sign for domestic investors, as DIIs (domestic institutional investors) have bought a large number of shares.

Role of foreign investors

Foreign institutional investors (FIIs) sold shares worth Rs 15,659 crore on November 18, while domestic institutional investors (DIIs) bought shares worth Rs 9,190 crore on the same day. This indicates that the confidence of domestic investors remains strong in the market, while foreign investors seem cautious.

State of Asian markets

There was a general bullish mood in the Asian markets as well. Except for Shanghai, other major Asian markets like Jakarta, Tokyo, Seoul, Bangkok, and Hong Kong saw a positive trend. On the other hand, the US stock markets had closed in the red on the previous trading day.

Thus, the Indian stock market has excited investors with a good start today, but it is important for investors to remain cautious as the direction of the market may be uncertain in the times to come.

--Advertisement--

Share

Share